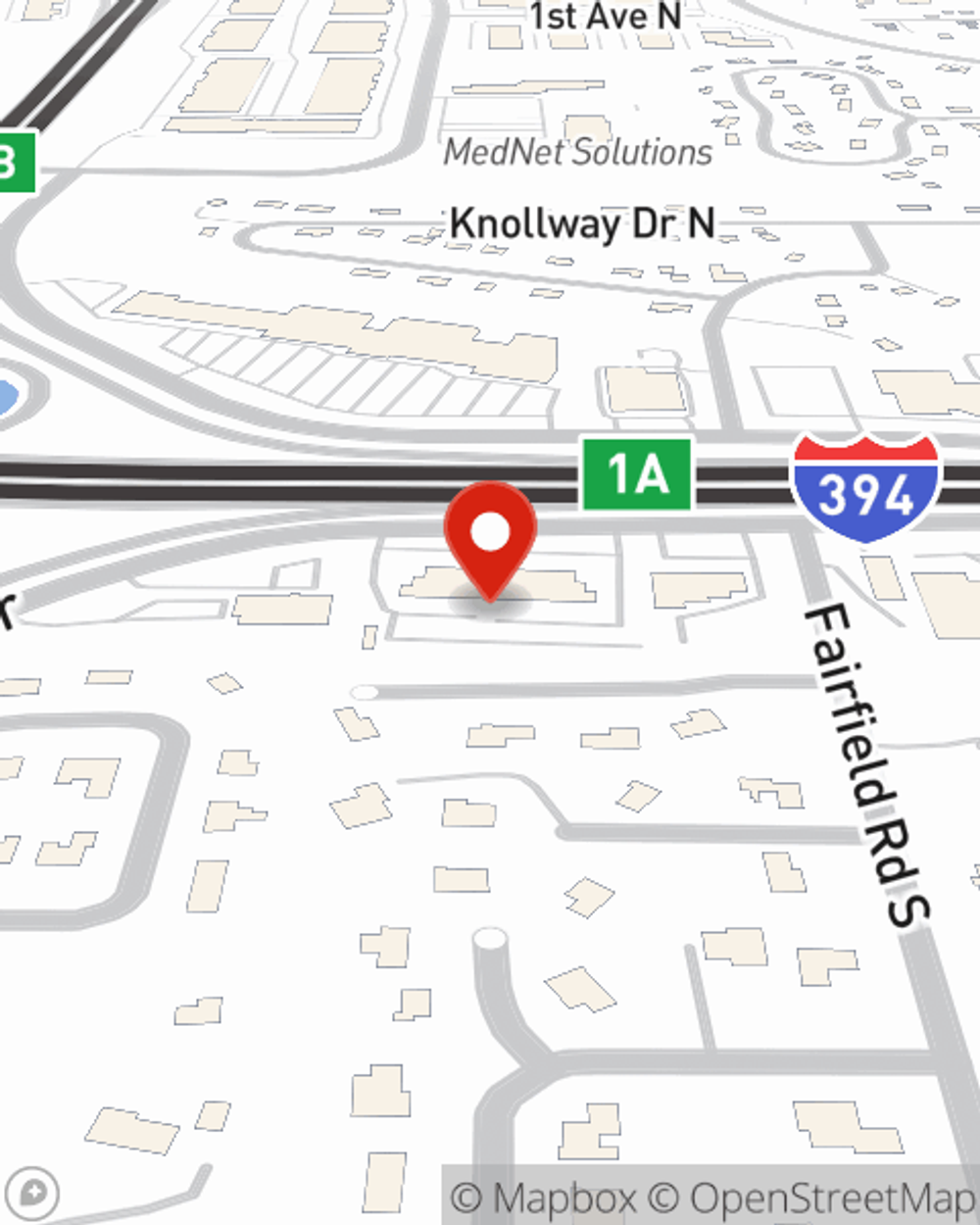

Business Insurance in and around Minnetonka

Calling all small business owners of Minnetonka!

Cover all the bases for your small business

- Minnetonka

- Plymouth

- Maple Grove

- Eden Prairie

- Wayzata

- Medina

- Hopkins

- St. Louis Park

- Golden Valley

Business Insurance At A Great Price!

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide quality insurance for your business. Your policy can include options such as errors and omissions liability, business continuity plans, and worker's compensation for your employees.

Calling all small business owners of Minnetonka!

Cover all the bases for your small business

Customizable Coverage For Your Business

At State Farm, apply for the excellent coverage you may need for your business, whether it's a donut shop, a pet store or a window treatment store. Agent Tyler Fandrich is also a business owner and understands your needs. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call Tyler Fandrich today, and let's get down to business.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Tyler Fandrich

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.